San Francisco Bay Area 2015 Economic Engine

We hear people referring to the current Bay Area economy as the boom phase of a boom/bust cycle: “We are in a repeat of the dot-com bubble.” Wrong! A line that moves up and down but consistently ratchets up is not a cycle, it is a trend. The Bay Area is experiencing real economic and population growth and we need to deal with it. This trend will not reverse if we choke off the necessities of urban life; limiting housing, transit and other infrastructure. Choking off these necessities will only make us all miserable.

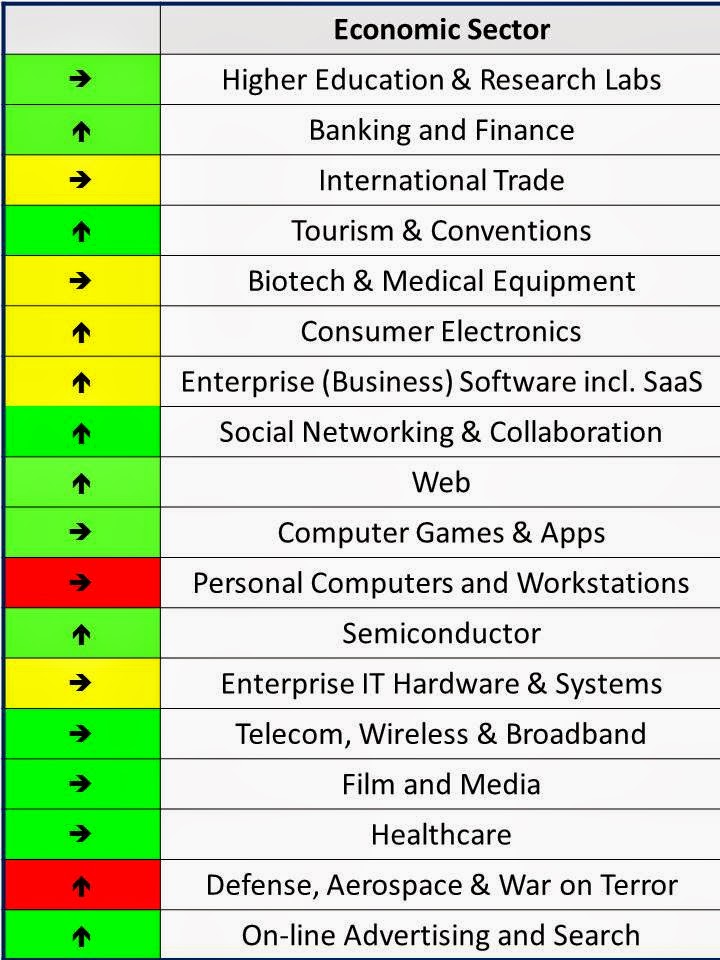

Each year I do an economic survey of the various drivers of the Bay Area economy, to help Newmark Realty Capital’s lenders and investor clients make plans for the coming year.

Many lenders used to refer to “the Tech Sector” as though it were a single industry, and feared the boom/bust oscillations. But in my survey, I breakdown “Tech” into its leading industries. This helps demonstrate that these tech sectors are often on independent trajectories. The breakdown also helps demonstrate that “Tech” is not some separate industry out there. “Tech” is integrated into every aspect of the US economy, no matter how prosaic. And the players in these industries could not compete today without “Tech”. Agriculture already has self-driving combines. Trucking companies model deliveries and traffic, using GPS in real-time. A new car’s software costs more than the steel.

Tech is diverse and it is everywhere, but Tech innovation for many industries is in the Bay Area. Many industries only need one or at most two world centers for innovation. In fashion it is Paris. In cars it once was Detroit. In finance we have New York and London. But for many industries today the center of innovation is the Bay Area. And the consolidation of innovation hubs to the Bay Area is getting stronger.

The best and brightest, the innovators have a need to congregate. Not only to collaborate, but also that innovator, that star engineer, wants to know she can walk out her employer’s door tomorrow and walk in a door nearby and have her talent recognized for the value it can create.

Growth won't be choked

All sides of the political spectrum in the Bay Area need to deal with the fact that choking housing and infrastructure will not stop growth. If a fashion designer wants to make it big in Paris, that person will live in a basement and eat ramen noodles to live that dream. It is the same with the innovators who come to the Bay Area to make it big in Tech. We need to recognize that these innovators will not be discouraged and go home if they do not get a seat on BART or MUNI. But, others won’t get a seat either. And, the rest of us are likely to give up and move away before the tech innovator does.

Likewise, we need to deal with the fact that the talent in most of the Bay Area tech industries will continue to be well paid. Preventing housing construction will not keep them out; it only drives up the price of houses and rents. The tech innovator will be better able to afford to live in the Bay Area than the rest of us.

This is not a bubble... Let's plan for growth

We have a confluence of political interests who want to treat the Bay Area economy as if it is an oscillation of a steady state and thus deny the need to invest in infrastructure, plan regionally and promote density.

- One side of the political debate says, “Starve the Beast”. These “Progressives” are anything but progressive: You can’t promote progress and fight change. They resent the newly created wealth and think of economics as a choice as if it were a religion or political party. Growth is not something you can choose to believe in. Progressives are supply/demand curve deniers. The Progressives, like Donald Trump, want to build a wall and keep immigrants out, not at the Mexican border but around the Bay Area and especially their favorite neighborhoods in San Francisco.

- The other extreme also says, “Starve the Beast.” The Ayn Rand conservative and right-wing Republican cannot face the fact that infrastructure problems will only be solved with more government, the creation of regional authorities that can occasionally overrule the local town council and, yes, with more taxes and long-term bond obligations.

- The pragmatic middle says, “What Beast?” The majority are the proverbial frogs in the pot as the temperature slowly rises, who tolerate the consequences that come from not planning for growth. The center would prefer to stay out of politics. And if they see the need for density and infrastructure, they say, “If you are going to build something, do it over there but not in my back yard.”

The Bay Area economy recently exceeded Dot-Com boom employment peaks

The Bay Area’s infrastructure was highly stressed from 1999 to 2001 and because we have invested very little since then, the Bay Area’s infrastructure is equally stressed now. Local economic growth is accelerating and the slack in infrastructure and high-tech employment is long gone. Job growth in the Bay Area was 103,000 new jobs in 2013, 113,500 in 2014 and in the 12 months ending September 2015 we added 131,200 jobs. If we convert jobs to people at the USA ratio of 0.6 jobs per person, the last three years would supply employment for a population of 579,500: Equal to Redwood City, Menlo Park, Palo Alto, Mountain View, Cupertino, Sunnyvale and Santa Clara combined.

In 2014 GDP growth in the San Francisco/Oakland SMSA was up 6.4% and up 8.0% in Santa Clara County (Bureau of Economic Analysis): That is a China-level of growth without a China-level of investment in infrastructure.

We all recognize things are approaching a tipping point. We are exasperated by the traffic and the crowds on BART, MUNI and CalTrain. We sense the heightened competition for everything: an apartment, a house, a seat on the train, a slot for your child in your preferred school, a reservation at our favorite restaurants. Even if we do not admit it to ourselves, most of us wish we could dial the economy back a little.

The Bay Area economy is not going to burst

Yes, we have extreme valuations of the Bay Area’s herd of Unicorn’s, those 56 local start-ups that have achieved a valuation of over $1 billion. But this is a symptom of a zero-interest rate Fed policy that created the last financial crises and is creating another one. We have similar extreme valuations in all other asset classes; stocks, bonds, commercial real estate, homes and farms. Yes, we will have asset-price corrections that may devastate some start-ups, some speculators and some of their lenders. But, the economic drivers of the Bay Area are diverse, generally healthy and growing in strength. More importantly, the pace of innovation is intensifying and this pace, plus the need for cross-pollination between technologies is making the Bay Area the location as the innovation hub for more and more industries. These local innovation hubs attract big companies, the leaders of their industries, not just start-ups.

Will the growth phase pause?

Yes, but the ratchet mechanism of Bay Area’s population is still in place. A ratchet works by a brake that prevents movement in the backward direction. The force may move in both directions but the brake prevents movement back to the original starting place.

What is the Bay Area’s population brake? Simply put, the Bay Area is a wonderful place to live. People came for the gold rush, to build the railroads, to rebuild San Francisco after the quake, to build the machinery of war in WW2, to design and build the implements of the cold war and the space race. Each time most of the people stayed even if the employment prospect that brought them to the Bay Area petered out. In the last cycle when the dot-com bubble collapsed, Santa Clara had one of the largest sudden losses of urban employment since the great depression, but Silicon Valley’s population declined very little. People stayed even if it meant having to create their own work by starting a company themselves. Some of these companies survived and some of these survivors started whole new industries. The upward ratcheting of the Bay Area’s population continued and will not stop.

We in the Bay Area need to adopt the mindset of the Greatest Generation. We need to look for leaders who can be more like Dwight Eisenhower and the First Governor Brown, leaders who have the vision to plan for growth so that California will be better, not worse off because of growth.